Table of Contents

ToggleLISTEN TO THIS ARTICLE

Preparing Your Business for Success: A Comprehensive Guide to Year-End Planning and Future Growth

As another fiscal year draws to a close, business owners find themselves at a critical juncture. Whether the past twelve months have brought unprecedented success or presented significant challenges, the transition into a new year offers a valuable opportunity for reflection, reorganization, and strategic repositioning.

The question isn't simply about surviving another year—it's about creating intentional pathways toward sustainable growth and operational excellence.Every enterprise, regardless of size or industry, faces this annual moment of truth. Some entrepreneurs will maintain their current trajectory, continuing with familiar patterns and established routines.

Others will recognize this period as the perfect catalyst for implementing transformative changes. The decisions made during these crucial weeks can fundamentally reshape a company’s prospects for the coming year and beyond.

Understanding where your business stands today requires honest assessment. Have you achieved the milestones you set out to reach? Did unexpected obstacles derail your plans, or did opportunities emerge that shifted your priorities? Perhaps you’ve discovered that certain customer segments deserve more attention, while others drain resources without providing adequate returns.

Maybe your operational capacity has reached its limit, or conversely, you’re struggling to fill the pipeline with enough work to sustain your team.

These questions matter because they inform the strategic choices ahead. Business planning isn’t merely an administrative exercise—it’s a critical thinking process that separates thriving enterprises from those that simply exist.

The organizations that invest time in thoughtful year-end planning position themselves to capitalize on opportunities while building resilience against future challenges.

The Psychology of Deadlines and Productivity

One fascinating aspect of year-end planning involves the psychological impact of deadlines on productivity and decision-making. Many business owners notice a phenomenon where the approach of a firm deadline—whether it’s the calendar year-end planning or an upcoming vacation—suddenly catalyzes action on tasks that have languished for months.

This observation reveals an important principle about human behavior and organizational management: artificial constraints can drive real results. When business owners impose concrete deadlines on themselves and their teams, projects that seemed perpetually incomplete suddenly reach completion.

The looming end of the year creates natural urgency that can be harnessed to close out pending initiatives, finalize delayed decisions, and clear the decks for fresh starts.

The lesson here extends beyond year-end planning. Successful entrepreneurs learn to create and enforce deadlines throughout the year, understanding that time constraints focus attention and accelerate execution.

However, the year-end planning deadline carries special significance because it aligns with accounting cycles, tax considerations, and the psychological appeal of new beginnings.

By recognizing this deadline-driven productivity boost, business leaders can intentionally structure their operations to take advantage of it. Rather than allowing year-end planning to become a frantic scramble, strategic planning transforms this period into a powerful catalyst for organizational progress.

Essential Financial Housekeeping Before Year-End Planning

Financial management forms the foundation of business success, yet many entrepreneurs treat bookkeeping as an afterthought rather than a strategic priority.

As the fiscal year concludes, ensuring your financial records accurately reflect business reality becomes critically important for multiple reasons: tax compliance, performance analysis, strategic planning, and potential financing needs.

Achieving Complete and Accurate Financial Records

The first priority involves ensuring every financial transaction has been properly recorded and categorized.

This process, often called "closing the books," requires more than simply entering numbers into accounting software. It demands careful reconciliation between your internal records and external documentation like bank statements and credit card accounts.

Many businesses discover discrepancies during this process—unexplained transactions, duplicate entries, or categorization errors that have accumulated throughout the year.

Addressing these issues promptly prevents small problems from compounding into major headaches later. Moreover, clean financial records provide the accurate data needed for meaningful business analysis.

When every transaction is properly documented and categorized, you gain clear visibility into where money actually goes within your operation.

This granular understanding often reveals surprising patterns: expenses that seemed minor individually might represent significant costs when aggregated across twelve months, or revenue sources you considered secondary might actually drive more profit than your primary offerings.

Financial statements—particularly your profit and loss statement and balance sheet—tell the story of your business’s financial health. However, these documents only provide valuable insights when the underlying data is accurate and complete.

Garbage in, garbage out, as the saying goes. Investing effort now to ensure data quality pays dividends throughout the coming year.

Managing Accounts Receivable Strategically

Outstanding invoices represent money you’ve earned but haven’t collected—a situation that creates unnecessary cash flow stress for many businesses.

As the year concludes, taking aggressive action to collect overdue payments can significantly improve your financial position heading into the new year.

Several strategies can accelerate collections without damaging customer relationships. Offering modest early payment discounts incentivizes prompt payment while demonstrating appreciation for customers who prioritize paying their vendors.

Even a small discount—perhaps two or three percent—often motivates payment when the alternative is letting invoices age another month or quarter.

For seriously overdue accounts, more direct communication becomes necessary. Personal outreach, whether by phone or email, often works better than automated reminders.

Many times, unpaid invoices result from administrative oversights rather than financial problems or dissatisfaction. A simple phone call can trigger immediate payment by bringing the outstanding balance back to the customer’s attention.

In cases where standard collection efforts fail, businesses must decide whether to engage professional collection services. While this option involves fees and potentially damages relationships, it may be preferable to writing off the debt entirely.

Each situation requires individual assessment based on the amount owed, the customer relationship, and the likelihood of eventual payment.Beyond immediate collections, year-end planning provides an opportunity to evaluate your overall accounts receivable management. Are payment terms clearly communicated and consistently enforced? Do you have efficient systems for tracking invoices and following up on late payments?

Are there customers whose chronic late payment justifies changing terms or even discontinuing the relationship? These systemic questions matter as much as collecting specific outstanding balances.

Comprehensive Expense Review and Optimization

While revenue deservedly receives considerable attention, expense management often offers more immediate opportunities for improving profitability. A thorough review of business expenditures frequently uncovers costs that no longer serve their intended purpose or could be reduced through renegotiation or alternative solutions.

Start by categorizing expenses into essential, beneficial, and questionable buckets. Essential expenses directly enable core business operations—rent, utilities, key equipment, critical software, and similar items.

Beneficial expenses support but don’t directly enable operations—they include marketing, professional development, upgraded equipment, and various tools that enhance productivity or capability.

Questionable expenses deserve scrutiny—subscriptions that go unused, memberships that provide minimal value, or services that duplicate capabilities you already possess.

This categorization exercise often reveals surprising results. Many businesses discover they’re paying for software subscriptions no one uses, services that were needed for a specific project but continued after completion, or memberships that were useful initially but no longer align with current business needs.

Eliminating these orphaned expenses typically requires minimal effort but can meaningfully impact the bottom line.

For legitimate ongoing expenses, year-end planning presents an ideal time to renegotiate terms with vendors. Many suppliers would rather maintain business relationships at slightly reduced margins than lose customers to competitors.

Having documented data on your spending gives you leverage in these negotiations. Similarly, competitive bidding for services like insurance, telecommunications, or professional services often yields significant savings.

The expense review process shouldn’t focus solely on cutting costs. Sometimes increased spending in strategic areas generates strong returns. Investing in better equipment might reduce maintenance costs and downtime.

Upgrading software could dramatically improve productivity. Enhanced marketing efforts might generate revenue that far exceeds the additional expenditure. The goal is optimizing expense allocation, not minimizing spending regardless of consequences.

Understanding and Managing Tax Obligations

Tax compliance represents a non-negotiable aspect of running a business, yet the complexity of tax codes means many entrepreneurs lack full understanding of their obligations and opportunities.

While this discussion cannot and should not replace professional tax advice, business owners benefit from developing basic tax literacy.

Different business structures face different tax situations. Sole proprietorships report business income on personal tax returns. Partnerships distribute income to partners who report their shares individually.

Corporations face corporate taxation, though S-corporations provide pass-through taxation similar to partnerships. Limited liability companies can elect different tax treatments depending on their circumstances.

Beyond understanding your structure’s basic tax treatment, awareness of deductible expenses and available tax credits can significantly impact your tax liability.

Many business expenses reduce taxable income when properly documented and categorized—travel for business purposes, equipment purchases, professional services, certain vehicle expenses, home office costs, and numerous other items may qualify for deductions when legitimately connected to business activities.

Tax credits differ from deductions by directly reducing taxes owed rather than simply reducing taxable income.

Various credits exist for different business activities, from research and development to hiring individuals from certain targeted groups to implementing energy-efficient improvements. Investigating applicable credits may uncover valuable tax reduction opportunities.

Estimated tax payments present another critical consideration for many business owners. Unlike employees who have taxes withheld from paychecks, self-employed individuals and business owners must proactively calculate and remit estimated taxes quarterly. Falling behind on these payments can result in penalties and interest charges that compound financial stress.

Year-end planning tax planning often involves timing decisions around when to recognize income or incur expenses. For businesses using cash-basis accounting, delaying invoicing until January defers that income to the following tax year, while accelerating year-end planning purchases might increase current-year deductions.

These tactical decisions should align with overall business strategy and tax situation rather than being made in isolation.However, making sound tax decisions requires professional guidance. Tax laws change frequently, vary by jurisdiction, and contain nuances that significantly impact outcomes.

Engaging qualified tax professionals—certified public accountants or enrolled agents—ensures compliance while maximizing legitimate tax advantages. The cost of professional tax assistance typically represents a small fraction of the potential savings and penalty avoidance it enables.

Preparing for Upcoming Compliance Deadlines

Understanding the calendar of tax filing deadlines prevents last-minute scrambles and late filing penalties.

Different entities face different deadlines, and extensions may be available in many situations. However, extensions to file don’t extend the time to pay taxes owed—interest and penalties still accrue on unpaid balances regardless of filing extensions.

For businesses required to make estimated quarterly tax payments, marking these dates and ensuring adequate cash reserves prevents the stressful situation of owing taxes without available funds.

Many businesses maintain separate savings accounts specifically for tax obligations, transferring estimated amounts regularly so funds are available when payments come due.

Beyond federal taxes, businesses must stay current with state and local tax obligations, which vary considerably depending on location.

Sales taxes, franchise taxes, property taxes, and various fees all carry their own deadlines and requirements.

Maintaining a comprehensive compliance calendar that encompasses all tax and regulatory deadlines helps ensure nothing falls through the cracks.Strategic Planning for Sustained Growth

While financial housekeeping addresses the mechanics of closing out a fiscal year, strategic planning focuses on what comes next.

This forward-looking process determines direction, allocates resources, and establishes accountability for achieving specific objectives during the coming year.

Conducting Meaningful Performance Analysis

Before charting a course forward, understanding where you’ve been provides essential context. Performance analysis examines what worked, what didn’t, and why—enabling evidence-based decision making rather than relying on assumptions or anecdotal impressions.

Begin by identifying your most significant successes during the past year. Which initiatives exceeded expectations? What customer segments grew most rapidly? Which products or services generated the strongest margins? What operational improvements delivered meaningful results?

Documenting these wins serves multiple purposes: recognizing team contributions, identifying repeatable patterns worth expanding, and building confidence that growth is achievable.Equally important, honest assessment of disappointments and failures provides crucial learning opportunities. Which initiatives fell short of goals? What marketing efforts failed to generate expected returns?

Where did execution break down despite solid planning? Which customer relationships deteriorated? Analyzing these setbacks without defensiveness reveals obstacles that must be addressed or avoided.

The goal isn’t assigning blame—it’s extracting lessons. Perhaps a failed initiative wasn’t inherently flawed but was poorly timed or inadequately resourced.

Maybe a customer relationship soured due to miscommunication rather than fundamental incompatibility. Understanding root causes rather than surface symptoms enables corrective action.

Beyond internal performance, analyzing market trends and competitive dynamics provides critical context. Has your industry grown or contracted? Have new competitors emerged or established players exited?

What technological, regulatory, or economic shifts affected your business environment? How do your performance metrics compare to industry benchmarks?

This comprehensive review creates a foundation for evidence-based planning. Rather than setting goals based on wishful thinking, you can project realistic targets based on demonstrated capabilities while identifying specific areas requiring improvement or investment.

Establishing Meaningful, Measurable Objectives

Goal setting represents a critical but often poorly executed aspect of business planning. Vague aspirations like “grow the business” or “improve customer satisfaction” lack the specificity needed to drive action or measure progress.

Effective goals follow the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound.

Specific goals clearly define what success looks like. Rather than “increase revenue,” a specific goal might state “increase monthly recurring revenue from subscription services by 25%.” The specificity eliminates ambiguity about what’s being measured and whether it’s been achieved.

Measurable goals include quantifiable metrics that enable tracking progress. You might measure customer satisfaction through Net Promoter Score surveys, gauge marketing effectiveness through qualified lead generation, or assess operational efficiency through order fulfillment times.

Whatever metrics you choose, they must be objectively measurable rather than subjectively assessed.

Achievable goals stretch capabilities without being unrealistic. Setting a goal to triple revenue in twelve months might be possible for an early-stage startup but unrealistic for an established business.

Goals should challenge you and your team while remaining grounded in reality given available resources and market conditions.

Relevant goals align with broader business priorities and circumstances. A struggling business might prioritize profitability over growth, while a well-capitalized startup might aggressively pursue market share even at the expense of near-term profits. Goals should reflect your specific situation and strategic priorities.

Time-bound goals include deadlines that create urgency and enable progress tracking. Rather than open-ended objectives, effective goals specify target dates: “Launch new product line by end of second quarter” or “Reduce customer acquisition cost by 20% within six months.”

For each major goal, identify the key actions required to achieve it. Who is responsible for each action? What resources do they need? What obstacles might impede progress?

How will you track advancement toward the goal? This operational detail transforms aspirational objectives into executable plans.

Designing Your Growth Strategy

With clear goals established, developing a coherent strategy for achieving them becomes the next critical step. Growth can occur through multiple pathways: expanding product or service offerings, entering new markets, increasing market share in existing segments, improving pricing, enhancing operational efficiency, or various combinations of these approaches.

Product or service expansion allows businesses to serve existing customers more comprehensively or attract new customer segments. This approach works particularly well when you have strong customer relationships and understand their broader needs.

However, expansion requires careful consideration of whether new offerings align with your core capabilities and whether market demand justifies the investment.

Market expansion involves serving new geographic regions or customer segments with existing offerings. This strategy leverages proven products or services while accessing fresh revenue sources. Success depends on understanding how new markets differ from familiar ones and adapting your approach accordingly.

Market share growth focuses on capturing a larger portion of your existing market. This typically requires competitive differentiation—offering superior value through better quality, lower prices, enhanced service, or unique features.

Competitive positioning must be sustainable rather than easily replicated by competitors.

Pricing optimization can dramatically impact profitability, sometimes more than volume growth. Many businesses leave money on the table by underpricing their offerings relative to the value delivered.

Conversely, some price too high and lose market share to competitors. Understanding your value proposition and target market’s willingness to pay informs optimal pricing strategies.

Operational efficiency improvements reduce costs and improve customer experience simultaneously. Streamlining workflows, automating repetitive tasks, upgrading equipment, and refining processes all contribute to operational excellence. While less visible than revenue growth, efficiency gains directly enhance profitability.

Most successful growth strategies combine multiple approaches rather than relying exclusively on any single pathway. The specific combination should reflect your circumstances, capabilities, and market opportunities.

Importantly, ideas alone don’t drive growth—execution delivers results. Every strategic initiative needs an implementation plan detailing specific actions, responsible parties, required resources, deadlines, and success metrics.

Without this operational detail, strategies remain abstract concepts rather than practical roadmaps.

Balancing Customer Acquisition and Retention

Business growth requires both attracting new customers and retaining existing ones, yet many organizations overemphasize acquisition while neglecting retention. This imbalance proves costly because acquiring new customers typically costs significantly more than retaining current ones, and long-term customers often generate higher lifetime value through repeat purchases and referrals.

Customer acquisition strategies vary by industry and target market but generally involve some combination of marketing, sales, and partnership activities. Digital marketing—search engine optimization, paid advertising, social media, content marketing—provides scalable tools for reaching prospects.

Traditional marketing channels like print advertising, direct mail, trade shows, and broadcast media remain relevant for certain markets. Referral programs leverage satisfied customers to generate qualified leads at relatively low cost.

Whatever acquisition channels you employ, understanding economics is critical. Calculate your customer acquisition cost by dividing total marketing and sales expenses by the number of new customers acquired.

Compare this to customer lifetime value—the total profit expected from a customer relationship. Sustainable businesses acquire customers at costs substantially lower than their lifetime value.

Customer retention often receives insufficient attention despite its critical importance. Satisfied customers who continue purchasing represent predictable revenue streams with minimal acquisition cost.

Moreover, long-term customers often increase their spending over time as trust develops and needs expand.

Retention strategies should address the entire customer experience from initial purchase through ongoing service. Clear communication, reliable delivery, responsive support, and genuine appreciation all contribute to customer loyalty.

Proactive outreach—checking in periodically, sharing relevant information, offering assistance before problems emerge—demonstrates that you value the relationship beyond transactional revenue.

Some businesses discover that certain customers consume disproportionate resources relative to their revenue contribution. These challenging relationships might involve unreasonable demands, chronic late payment, or excessive service requirements.

While every business should strive for customer satisfaction, sometimes discontinuing problematic relationships benefits both parties. The capacity freed by ending a difficult relationship can be redirected toward more productive, mutually beneficial customer partnerships.

Conversely, identifying your best customers—those who pay promptly, communicate clearly, appreciate your work, and generate strong margins—enables focused efforts to serve them exceptionally well.

Strengthening these valuable relationships through enhanced service, preferential pricing, or other benefits can increase both retention and revenue.

Investing in Team Development

Your team represents your most valuable asset and your greatest opportunity for competitive advantage. While competitors can replicate products, copy pricing, or imitate marketing, they cannot duplicate your specific combination of talented, trained, committed people working in alignment toward shared goals.

Team development encompasses multiple dimensions: skill enhancement, leadership development, cultural reinforcement, and strategic hiring. Each contributes to organizational capability and effectiveness.

Skill development ensures team members possess the capabilities needed to execute your strategy. As business needs evolve, training helps existing employees adapt rather than requiring constant turnover.

Many industries offer professional development opportunities through workshops, conferences, online courses, and certification programs. Investing in employee growth demonstrates commitment to their success while enhancing organizational capacity.

Leadership development prepares individuals for expanded responsibilities as the organization grows. Identifying high-potential team members and providing mentoring, stretch assignments, and leadership training builds the bench strength needed for sustainable scaling.

External leadership programs can supplement internal development while exposing emerging leaders to broader perspectives.

Cultural reinforcement maintains organizational values and norms as teams grow and evolve. Company culture—the shared beliefs, behaviors, and practices that characterize how work gets done—significantly impacts performance, satisfaction, and retention.

Intentional culture building through regular communication, recognition programs, team building activities, and consistent modeling of desired behaviors helps preserve what makes your organization distinctive.

Strategic hiring addresses skill gaps and enables growth by bringing in capabilities that don’t currently exist within the team. However, hiring decisions carry significant long-term implications, so rushing the process typically proves counterproductive.

Taking time to clearly define role requirements, thoroughly evaluate candidates, and assess cultural fit increases the likelihood of successful hires.

Many government programs and private grants provide funding specifically for training initiatives. Exploring these opportunities can reduce the financial burden of professional development while demonstrating commitment to workforce investment.

Maintaining Market Awareness and Adaptability

Market conditions, competitive dynamics, regulatory environments, and technological capabilities all evolve continuously. Businesses that maintain awareness of these changes and adapt accordingly position themselves to capitalize on opportunities while avoiding threats.

Industry awareness involves tracking trends, monitoring competitors, understanding regulatory developments, and following technological advances relevant to your business.

Trade publications, industry associations, professional networks, conferences, and market research all provide valuable information sources. Dedicating regular time to this environmental scanning prevents being blindsided by changes that savvier competitors anticipated and prepared for.

However, information only creates value when it informs decisions and actions. Establishing processes for evaluating emerging trends and determining their implications for your business transforms awareness into competitive advantage.

Some developments might represent threats requiring defensive responses, while others present opportunities worth pursuing.

Adaptability requires both willingness and capacity to change. Organizations develop rigidity through ingrained habits, established relationships, legacy systems, and simple comfort with familiar approaches.

Overcoming this inertia demands conscious effort and leadership commitment to continuous improvement and evolution.

At the same time, not every trend deserves pursuit. Distinguishing meaningful shifts from temporary fads requires judgment based on understanding your customers, market, and capabilities. The goal is strategic adaptation, not reactive flailing in response to every new development.

Building Business Resilience

Beyond pursuing growth, protecting and strengthening your business against various risks enhances long-term sustainability. Resilience doesn’t mean avoiding all risks—entrepreneurship inherently involves risk-taking.

Rather, it means understanding risks, managing them intelligently, and building capacity to withstand unexpected challenges.

Diversifying Revenue Sources

Revenue concentration creates vulnerability. Businesses overly dependent on a single customer, product, market, or distribution channel face existential risk if that source falters. Diversification spreads risk across multiple revenue streams so that problems in any single area don’t threaten overall viability.

Customer concentration particularly deserves attention. Having one customer represent more than twenty or thirty percent of revenue creates dangerous dependency.

That customer’s financial problems, strategic shifts, or simple decision to change vendors can devastate your business. Actively working to broaden your customer base reduces this vulnerability.

Similarly, product or service concentration means that market changes affecting your primary offering threaten your entire business. Expanding your portfolio provides alternative revenue sources and better positions you to serve diverse customer needs.

Geographic diversification protects against regional economic downturns or local competitive pressures. Businesses serving multiple markets aren’t hostage to conditions in any single location.

Channel diversification reduces dependency on any single distribution method. Companies selling exclusively through one retailer, one online platform, or one partnership relationship face significant risk if that channel closes or becomes less favorable.

While diversification provides risk management benefits, it must be pursued strategically rather than scattershot. Each new revenue stream requires investment and attention.

Better to thoughtfully develop a few carefully selected diversification initiatives than to spread resources too thin across many marginally viable opportunities.

Maintaining Financial Reserves

Cash reserves provide breathing room when unexpected expenses arise or revenue temporarily declines. Businesses operating without reserves face constant stress and lack flexibility to seize opportunities or weather challenges.

Financial advisors typically recommend maintaining operating reserves sufficient to cover three to six months of essential expenses.

This cushion enables you to handle equipment failures, customer payment delays, temporary market downturns, or other disruptions without immediately facing existential crisis.

Building reserves requires discipline—setting aside a portion of profits during good times rather than spending every dollar available. However, this financial buffer proves invaluable during difficult periods, potentially making the difference between surviving a rough patch and being forced to close.

Beyond emergency reserves, maintaining adequate working capital ensures you can fund operations without constant cash flow stress.

Many businesses experience seasonal fluctuations or payment timing mismatches where expenses come due before customer payments arrive. Working capital bridges these gaps, enabling smooth operations despite timing discrepancies.

Managing Business Risk Through Insurance

Insurance transfers certain risks to carriers in exchange for premium payments.While insurance represents an ongoing expense, it protects against potentially catastrophic losses that could destroy your business.

General liability insurance covers claims of bodily injury or property damage caused by your business operations. Professional liability (errors and omissions) insurance protects against claims of negligence or inadequate work.

Property insurance covers physical assets like buildings, equipment, and inventory. Business interruption insurance compensates for lost income when operations are disrupted by covered events.

Depending on your business type, additional specialized insurance might be necessary or advisable: cyber liability for technology-dependent businesses, workers’ compensation where required by law, product liability for manufacturers, commercial auto for vehicle-dependent operations, and various other policies addressing specific risks.

Working with insurance professionals who understand your industry helps ensure adequate coverage without paying for unnecessary policies.

Regularly reviewing insurance as your business evolves ensures protection keeps pace with changing risks and exposures.

Protecting Intellectual Property and Competitive Advantages

Intellectual property—trademarks, copyrights, patents, trade secrets, proprietary processes—often represents substantial business value that deserves protection.

Failing to secure intellectual property rights can enable competitors to freely exploit innovations, brands, or creative works you developed.

Trademark protection prevents others from using confusingly similar names, logos, or branding that could mislead customers. Copyright protects original creative works like writing, images, software, and other expressive content.

Patents protect inventions and certain processes, though they require formal application and approval. Trade secrets protect confidential information that provides competitive advantage.

Understanding which intellectual property protections apply to your business and taking appropriate steps to secure them prevents value loss through unauthorized copying or competitive appropriation.

While intellectual property law involves complexity requiring professional guidance, awareness of basic concepts helps business owners recognize what deserves protection.

Establishing Contingency Plans

Despite best efforts, unexpected problems inevitably arise: key employees leave, major equipment fails, natural disasters strike, critical suppliers go out of business, cyberattacks compromise systems, or countless other disruptions occur.

Contingency planning involves identifying plausible scenarios that could significantly impact operations and developing response plans. While you cannot prepare for every possibility, thinking through likely scenarios and determining appropriate responses enhances your ability to manage crises effectively.

Business continuity planning specifically addresses maintaining operations during disruptions. Can you continue serving customers if your primary facility becomes unavailable? What happens if key personnel are suddenly unavailable? How quickly can you restore systems after a cyber incident? Could you shift to alternative suppliers if current ones fail?

Having documented contingency plans, even basic ones, accelerates response during actual crises when stress and urgency impair clear thinking. Organizations that have considered scenarios and prepared responses navigate disruptions far better than those reacting entirely ad hoc.

The Critical Role of Professional Advisors

Running a successful business requires expertise across multiple domains: finance, legal, marketing, operations, human resources, technology, and various industry-specific specialties.

No business owner possesses deep expertise in every relevant area, making professional advisors invaluable resources.Financial and Accounting Professionals

Accountants and financial advisors provide expertise in areas where mistakes can prove costly. Beyond basic bookkeeping and tax compliance, these professionals help with financial analysis, cash flow forecasting, financial strategy, tax planning, and early warning identification when problems emerge.

Many business owners view accounting as merely a compliance necessity rather than a strategic resource. However, accountants with strong business advisory capabilities can provide insights that meaningfully impact profitability, tax efficiency, and growth strategies.

Bookkeepers handle day-to-day transaction recording and reconciliation. Accountants provide broader financial services including financial statement preparation, tax compliance, and business advisory.

Certified Public Accountants (CPAs) have met specific educational and licensing requirements, while enrolled agents specialize in tax representation. Depending on complexity and needs, businesses might engage some combination of these professionals.

The value professional accountants provide typically far exceeds their fees through tax savings, financial insights, problem identification, and simple peace of mind from knowing experts handle critical financial matters.

Trying to economize by avoiding professional assistance often proves more expensive in the long run through missed opportunities, compliance failures, or poor financial decisions.

Legal Counsel

Legal issues pervade business operations: entity formation, contracts, employment matters, regulatory compliance, intellectual property, litigation, and various other areas all involve legal considerations.

While not every business interaction requires attorney involvement, having access to competent legal counsel proves essential when issues arise.Many businesses benefit from establishing relationships with attorneys before problems develop rather than scrambling to find legal help during crises.

Attorneys familiar with your business can provide more efficient, effective service because they already understand your operations and circumstances.

Different attorneys specialize in different practice areas. Business formation and contracts might be handled by a corporate attorney, while employment matters might require a labor and employment specialist.

Intellectual property demands attorneys with specific technical expertise. Having relationships with attorneys covering relevant specialties ensures appropriate expertise for diverse legal needs.

While legal services represent significant expenses, preventing problems through proper legal structuring, clear contracts, and compliance with regulations typically costs far less than resolving disputes or addressing violations after they occur.

Marketing and Business Development Specialists

Marketing requires specialized knowledge that many business owners lack despite its critical importance for growth. Digital marketing particularly involves technical complexity and rapid evolution that make professional expertise valuable.

Marketing consultants and agencies can provide strategy development, campaign execution, content creation, analytics interpretation, and various specialized services.

For businesses without internal marketing expertise, outsourcing to professionals often delivers better results than amateur efforts while freeing ownership to focus on core competencies.

Business development consultants help identify growth opportunities, develop strategic plans, and improve operational efficiency. These advisors bring outside perspectives and specialized methodologies that complement internal knowledge and expertise.

CLICK HERE TO GET OUR TOTAL BUSINESS BUILD OUT PACKAGE!

Practical Financial Considerations for Growth

Ambitious growth plans often require capital beyond what current operations generate. Understanding funding options enables businesses to access resources needed for expansion while managing the associated obligations and implications.

Traditional Bank Lending

Traditional bank loans provide capital at relatively low interest rates but typically require strong credit histories, collateral, and demonstrated financial stability.

Banks thoroughly evaluate borrowers because they rely primarily on loan interest rather than equity participation for returns, making repayment ability their paramount concern.

Small Business Administration (SBA) loan programs partially guarantee loans, enabling banks to lend to businesses that might not qualify for conventional financing. SBA 7(a) loans provide general-purpose funding for various business needs.

SBA 504 loans specifically finance commercial real estate and major equipment purchases. While SBA loans involve more paperwork than conventional loans, they often provide favorable terms and lower down payments.

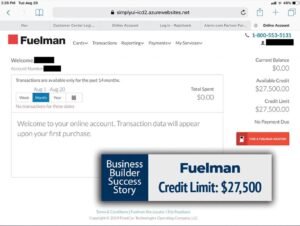

Alternative Financing Options

Beyond traditional bank loans, numerous alternative financing sources serve businesses that don't fit conventional lending criteria or need faster funding than traditional processes provide.Revenue-based financing provides capital in exchange for a percentage of future revenue rather than fixed monthly payments.

This structure aligns payment obligations with cash flow, potentially reducing stress during slow periods. However, the total repayment typically exceeds conventional loan amounts.

Invoice factoring converts outstanding invoices into immediate cash by selling them to factoring companies at a discount. This approach accelerates cash flow without creating debt obligations, though it reduces the amount ultimately collected from invoiced work.

Equipment financing enables businesses to acquire necessary equipment through loans secured by the equipment itself. Since the equipment serves as collateral, these loans may be easier to obtain than unsecured financing.

Lines of credit provide revolving access to capital up to a predetermined limit, similar to credit cards but typically with better terms. Businesses draw funds as needed and pay interest only on outstanding balances, providing flexible access to working capital.

Equity Financing Considerations

Equity financing involves selling ownership stakes to investors who provide capital in exchange for shares of the company. While equity doesn’t require repayment like debt, it dilutes ownership and may involve giving up some control over business decisions.

Angel investors—wealthy individuals who invest personal capital in early-stage businesses—often provide not just funding but mentorship and connections.

Venture capital firms invest larger amounts in high-growth-potential companies, typically seeking substantial returns through eventual sale or public offering.

Equity financing makes sense for businesses requiring significant capital for rapid growth and having realistic paths to eventual liquidity events that provide investor returns. However, it fundamentally changes ownership structure and governance, requiring careful consideration of implications.

Grant Funding Opportunities

Unlike loans or equity, grants provide funding that doesn't require repayment or ownership dilution. However, grants typically come with specific use restrictions, application requirements, and reporting obligations.

Government grants support various policy objectives: research and development, hiring from targeted populations, energy efficiency improvements, export development, and numerous other purposes.

Private foundations and corporations also offer grants supporting specific causes or communities.

Grant funding rarely appears on demand but discovering relevant opportunities and investing effort in strong applications can access valuable non-dilutive capital. Many businesses overlook grant opportunities simply due to lack of awareness or intimidation by application processes.

The Power of Strategic Networks

Business success increasingly depends on relationships and networks beyond what any single organization controls internally. Building strategic connections provides resources, knowledge, opportunities, and support that enhance capabilities and resilience.

Peer Networks and Entrepreneurial Communities

Other business owners understand challenges and opportunities in ways that employees, customers, or service providers cannot.

Peer networks provide venues for sharing experiences, seeking advice, comparing approaches, and finding solutions to common problems.

Formal peer groups like masterminds, industry associations, and business owner networks offer structured opportunities for relationship building and knowledge sharing. Informal connections through conferences, social events, and online communities can prove equally valuable.

The reciprocal nature of peer networks distinguishes them from commercial relationships. Members help each other not from profit motives but from shared understanding and genuine desire to support fellow entrepreneurs.

This mutual assistance creates value far exceeding what could be purchased from consultants or service providers.

Strategic Partnership Development

Partnerships with complementary businesses enable companies to offer comprehensive solutions exceeding what either could provide independently. Well-structured partnerships create mutual benefits where each party strengthens the other’s customer value proposition.

For instance, a web design firm might partner with a copywriting service, allowing both to offer complete website solutions while maintaining focus on core competencies.

A business attorney might partner with an accountant, enabling both to serve clients more comprehensively while generating referrals in both directions.

Successful partnerships require aligned values, complementary capabilities, clear communication, and fair value exchange. Formalizing partnership terms through written agreements prevents misunderstandings and ensures both parties understand expectations and obligations.

Thought Leadership and Industry Influence

Establishing recognized expertise within your industry or target market enhances credibility, generates leads, and creates opportunities for speaking engagements, media coverage, and other visibility. While building thought leadership requires sustained effort, it compounds over time as recognition spreads.

Content creation—blogs, articles, videos, podcasts, social media—demonstrates knowledge while providing value to audiences. Speaking at industry events and conferences amplifies reach and establishes authority.

Contributing to industry publications or participating in expert panels further builds recognition.

Thought leadership doesn’t happen overnight but consistently sharing valuable insights gradually builds reputation and influence. The cumulative effect opens doors that would otherwise remain closed while attracting opportunities rather than requiring constant business development efforts.

Operational Excellence as a Growth Foundation

Strategic planning and capital access matter little if operational execution falls short.

Operational excellence—consistently delivering quality products or services efficiently—provides the foundation supporting sustainable growth.

Process Documentation and Improvement

Many businesses operate based on informal knowledge residing in employees' heads rather than documented processes anyone can follow. This approach creates vulnerabilities when key people are unavailable and limits scalability because new employees face steep learning curves.

Process documentation captures how work gets done in written form that can be shared, trained, and improved.

While documentation requires upfront investment, it enables consistency, facilitates training, identifies improvement opportunities, and reduces dependency on specific individuals.

Once processes are documented, systematic improvement becomes possible. Analyzing workflows often reveals redundant steps, bottlenecks, or inefficiencies that weren’t apparent during routine operations.

Simplifying and streamlining processes reduces costs while improving quality and customer experience.Continuous improvement philosophies like Lean and Six Sigma provide methodologies for systematic operational enhancement, though even informal process review and refinement delivers value.

The key is regularly examining how work gets done and actively seeking better approaches rather than perpetually maintaining familiar patterns.

Technology Utilization for Efficiency

Technology offers tremendous potential for automating routine tasks, improving communication, enhancing customer experience, and enabling capabilities that would otherwise require substantially more resources.Customer relationship management (CRM) systems organize customer information and interaction history, ensuring nothing falls through the cracks while enabling personalized service at scale.

Project management software facilitates collaboration and tracking across teams and deadlines. Accounting software automates much of the tedious transaction recording and reconciliation that once required extensive manual effort.

Industry-specific software often provides specialized capabilities that general-purpose tools cannot match. While these solutions may involve higher costs, the efficiency gains and enhanced capabilities frequently justify the investment.

However, technology itself doesn’t automatically improve operations—it must be implemented thoughtfully and used consistently.

Purchasing software that sits unused or implementing systems without adequate training wastes resources while failing to deliver promised benefits. Successful technology adoption requires commitment to change management, training, and ongoing utilization.

Quality Management and Continuous Improvement

Quality—consistently meeting or exceeding customer expectations—represents a fundamental competitive advantage that's difficult for competitors to replicate.Businesses known for exceptional quality often maintain premium pricing while enjoying strong customer loyalty and referral generation.

Quality management involves establishing standards, measuring performance against those standards, identifying root causes of defects or failures, and implementing corrective actions.

This systematic approach prevents quality from being merely aspirational and instead makes it an operational reality.

Customer feedback provides invaluable insight into quality perceptions and improvement opportunities.

Actively soliciting feedback through surveys, reviews, direct conversations, and other channels demonstrates that you value customer opinions while gathering data for continuous improvement.

However, simply collecting feedback accomplishes nothing unless you act on what you learn. Responding to concerns, implementing suggested improvements, and following up with customers who experienced problems all demonstrate genuine commitment to quality and customer satisfaction.

Navigating Economic Uncertainty and Market Volatility

Economic conditions and market dynamics shift continuously, creating both challenges and opportunities. While business owners cannot control macroeconomic factors, they can prepare for various scenarios and position themselves to navigate whatever conditions emerge.

Economic Cycle Awareness

Economies cycle through periods of expansion, peak, contraction, and trough before beginning expansion again.

Understanding where the economy stands in this cycle informs strategic decisions around growth investment, expense management, cash reserves, and various other considerations.

During expansions, customer demand typically strengthens, making it an opportune time for growth investment, hiring, and market expansion.

Peak periods preceding contractions often show warning signs like slowing growth rates, rising costs, or increasing competition that suggest approaching downturn.

Contractions challenge businesses through declining demand, pricing pressure, and potentially constrained credit availability.

Companies entering recessions with strong balance sheets, diverse revenue sources, and efficient operations navigate downturns better than highly leveraged businesses dependent on continued expansion.

Troughs eventually give way to recovery, creating opportunities for well-positioned businesses to gain market share while competitors struggle. Having maintained capabilities through the downturn enables rapid response as conditions improve.

While predicting economic cycles with precision proves impossible, awareness of general patterns and current indicators helps inform prudent decision making.

Building resilience during good times provides capacity to weather inevitable downturns.

Scenario Planning for Different Futures

Rather than attempting to predict a single future with certainty, scenario planning considers multiple plausible futures and identifies strategies that perform reasonably well across diverse scenarios.

For instance, a business might consider scenarios involving continued economic growth, mild recession, severe downturn, or transformative technological disruption. For each scenario, what would success require? What investments would prove valuable? What risks would emerge? What opportunities might appear?

By considering diverse possibilities, businesses identify robust strategies that work across multiple scenarios rather than optimizing for a single expected future that may not materialize. This approach builds adaptability and reduces vulnerability to unexpected developments.

Conclusion: From Planning to Action

Strategic planning, financial preparation, operational improvement, and all the other topics discussed here only create value through execution. The transition from calendar year provides a natural catalyst for implementing changes, but following through separates successful businesses from those that perennially plan without improving.

Several principles enhance the likelihood of translating plans into results. First, accountability matters enormously—assigning clear responsibility for specific initiatives ensures someone owns each objective rather than everyone assuming someone else will handle it.

Regular progress reviews maintain focus and enable course corrections when implementation diverges from plans.

Second, starting immediately prevents plans from languishing. Momentum builds through initial actions that demonstrate commitment and begin generating early results. Even small steps forward matter more than perfect plans never implemented.

Third, celebrating progress reinforces positive behaviors and maintains motivation through the long implementation process. Acknowledging milestones reached, obstacles overcome, and improvements achieved creates positive reinforcement that sustains effort.

Fourth, maintaining flexibility allows adaptation as circumstances evolve. Plans represent hypotheses about effective strategies based on current understanding. When reality reveals flaws in those hypotheses, revising approaches demonstrates wisdom rather than weakness.

The new year offers a fresh start—an opportunity to build on past successes while addressing previous shortcomings.

Whether the coming twelve months represent your best year ever depends largely on choices you make now: the priorities you establish, the investments you pursue, the improvements you implement, the relationships you cultivate, and most importantly, the commitment you demonstrate to executing your vision.

Success rarely happens accidentally. It results from intentional effort applied consistently toward clear objectives.

The year-end planning transition provides an ideal moment to renew that commitment and reinvigorate your pursuit of business excellence. The future you build begins with the decisions and actions you take today.

Remember that building a successful, sustainable business represents a marathon rather than a sprint. Individual quarterly or annual results matter less than long-term trajectory.

By maintaining perspective, learning continuously, adapting thoughtfully, and persistently pursuing excellence, you position your business for sustained success regardless of whatever challenges or opportunities the future brings.

The question isn’t whether you’ll face obstacles—all businesses do. The question is whether you’ll have prepared yourself to overcome those obstacles while capitalizing on opportunities. That preparation begins with the year-end planning and execution process described throughout this guide.

Your future success depends on the commitment you bring to implementing these principles, adapting them to your circumstances, and maintaining discipline through both favorable and challenging times.

Make this coming year count by approaching it with intention, preparation, and unwavering commitment to building something meaningful and lasting.